Get the free arkansas new hire reporting form

Show details

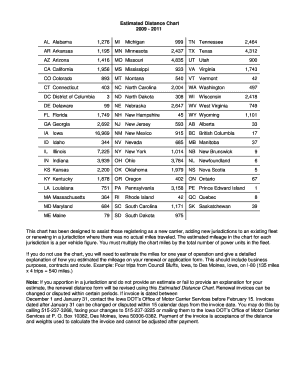

Arkansas New Hire Reporting Form Visit Our Website www. ar newhire. com Send completed form to PO BOX 2540 LITTLE ROCK AR 72203 Or fax to 1 800 259 3562 For more information 1 800 259 2095 Employer Information Please Print or Type Federal Employer Identification Number Employer Name Street Address City/State/Zip Code Contact Name/ Phone/Email Please list first last name Name REQUIRED SSN Address Start Date OPTIONAL Date of Birth State of Hire First day employee begins work for pay.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your arkansas new hire reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arkansas new hire reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arkansas new hire reporting online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ar new hire form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out arkansas new hire reporting

How to fill out Arkansas new hire form:

01

Obtain the Arkansas new hire form from the appropriate source, such as your employer or the Arkansas Department of Workforce Services website.

02

Fill in the employee's personal information, such as their full name, date of birth, social security number, and contact information.

03

Provide the employee's address, including street address, city, state, and zip code.

04

Enter the employee's job title, start date, and rate of pay.

05

Indicate whether the employee is exempt or non-exempt from overtime pay.

06

Provide information about the employer, including the business name, address, and employer identification number (EIN).

07

Fill in the employee's tax withholding information, including federal and state tax exemptions, and any additional withholding instructions.

08

Sign and date the form as the employer, and have the employee sign and date the form as well.

09

Submit the completed Arkansas new hire form to the appropriate agency or department, as instructed by your employer.

Who needs Arkansas new hire form:

01

Employers in Arkansas who hire new employees are required to complete the Arkansas new hire form.

02

This form is necessary for reporting new hires to the state for the purposes of child support enforcement and unemployment insurance.

03

Employers must ensure that this form is filled out correctly and submitted in a timely manner to comply with state regulations and obligations.

Fill arkansas new hire forms : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is arkansas new hire form?

The Arkansas new hire form is a document that employers in the state of Arkansas are required to complete and submit when they hire a new employee. This form gathers information about the new employee, including their personal details (such as name, address, and Social Security number), employment details (such as start date and wages), and information related to child support obligations, if applicable.

The purpose of the Arkansas new hire form is to facilitate the enforcement of child support orders by the Office of Child Support Enforcement. By submitting this form, employers provide the necessary information for the state to effectively track and collect child support payments from employees.

The Arkansas new hire form must be completed within 20 days of the new employee's hire date and submitted to the Arkansas Office of Child Support Enforcement. Failure to comply with this requirement can result in penalties for employers.

Who is required to file arkansas new hire form?

In Arkansas, both employers and employees are required to file the Arkansas New Hire Reporting Form. Employers must report newly hired employees within 20 days from the date of hire or the first day that services are performed for wages. On the other hand, employees are required to provide their employer with accurate information that is necessary for the completion of the form.

How to fill out arkansas new hire form?

To correctly fill out the Arkansas New Hire Reporting Form, please follow these steps:

1. Section A: Employer Information

- Provide your company's name, mailing address, and phone number.

- Enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- Indicate whether you are a government agency or a business.

2. Section B: Employee Information

- Fill in the employee's name, address, and Social Security Number (SSN).

- Select the appropriate box to indicate if the employee is a new hire or if there has been a rehire.

3. Section C: Employer's Job Information

- Enter the date the employee first performed services for your business.

- Specify the date of the first payment made to the employee.

4. Section D: Payment Information

- Provide details about the payment method (check, cash, or direct deposit), payment frequency, and starting and ending dates.

5. Section E: Employee's Information

- Indicate if the employee receives health benefits.

- Select the appropriate box to indicate if the employee is a contractor or exempt from Social Security.

6. Section F: Employee's Verification

- Have the employee sign and date the form to confirm the accuracy of the information provided.

7. Section G: Employer's Certification

- The employer or authorized representative needs to sign, date, and enter their name and title to certify that the information provided is accurate.

8. Section H: Contact Information

- Provide contact information, including the name, phone number, and email address, of the person responsible for New Hire Reporting.

9. Detach the "Employer Copy" portion of the form and retain it for your records.

10. Submit the completed form to the Arkansas New Hire Reporting Center:

- Online: Submit the form electronically through the Arkansas New Hire Reporting website.

- Mail: Send the form to the address provided on the form.

It's important to ensure the form is completed accurately and submitted in a timely manner to comply with Arkansas state regulations. Please consult the Arkansas New Hire Reporting instructions or website for any additional requirements or updates.

What is the purpose of arkansas new hire form?

The purpose of the Arkansas New Hire Form, also known as the Arkansas New Hire Reporting Form, is to collect and report information about newly hired employees in the state of Arkansas. This form is used to fulfill the requirements of the federal and state laws, including the federal Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) and the Arkansas New Hire Directory Program.

The Arkansas New Hire Form helps employers report information such as the employee's name, address, social security number, date of birth, date of hire, and employer's information to the Arkansas New Hire Reporting Center. This information is then used to identify and locate parents who owe child support, as well as to prevent and detect fraudulent activities related to various government programs.

By submitting the Arkansas New Hire Form, employers assist agencies in ensuring that child support obligations are met, improving the accuracy of unemployment compensation, workers' compensation, and public assistance programs, and promoting the overall integrity of the state's workforce.

What information must be reported on arkansas new hire form?

The following information must be reported on the Arkansas New Hire Reporting Form:

1. Employer and business information: This includes the name and address of the employer/company.

2. Federal Employer Identification Number (FEIN): The FEIN is a unique identification number assigned to each employer by the Internal Revenue Service (IRS).

3. Employer contact information: This includes the name, title, phone number, and email address of the employer or authorized representative.

4. Employee information: The form requires the following details for each new hire:

a. Full name (first, middle, and last)

b. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

c. Address (including zip code)

d. Date of hire

e. Supervisor's name

f. Wages or salary

5. Employer's state tax account number: This is the state-specific tax account number assigned to the employer by the Arkansas Department of Finance and Administration.

It is important to note that this information is subject to change, and it is recommended to consult the official Arkansas New Hire Reporting website or relevant state authorities for the latest requirements.

When is the deadline to file arkansas new hire form in 2023?

The deadline to file the Arkansas New Hire Form in 2023 may vary depending on specific circumstances. It is generally required to be filed within 20 days of hiring a new employee. However, it is recommended to check with the Arkansas Department of Workforce Services or consult a professional to ensure compliance and confirm the accurate deadline for filing.

What is the penalty for the late filing of arkansas new hire form?

The penalty for the late filing of the Arkansas New Hire Form varies depending on the circumstances. If an employer fails to file the form within 20 days of hiring or rehiring an employee, they may be subject to a fine of $25 per employee for the first offense. For subsequent offenses, the fine may increase to $500 per employee. Additionally, failure to file the form may result in the employer being reported to the Office of Child Support Enforcement for investigation and potential enforcement actions.

How can I modify arkansas new hire reporting without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ar new hire form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute arkansas new hire reporting form online?

With pdfFiller, you may easily complete and sign new hire reporting arkansas online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit arkansas new hire straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing printable arkansas new hire reporting form, you need to install and log in to the app.

Fill out your arkansas new hire reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas New Hire Reporting Form is not the form you're looking for?Search for another form here.

Keywords relevant to ar new hire reporting form

Related to arnewhire

If you believe that this page should be taken down, please follow our DMCA take down process

here

.